#DGFT code

Explore tagged Tumblr posts

Text

🧾AD Code Registration: A Mandatory Step for Exporters

1. 🧾 What is AD Code Registration? AD Code (Authorised Dealer Code) is a 14-digit numerical code issued by the bank that handles foreign exchange transactions of an exporter. This code must be registered with the Customs Department at the port of export through the ICEGATE portal. Without an AD Code registration, an exporter cannot generate a shipping bill, which is a mandatory customs document…

#AD code ICEGATE#AD Code registration#authorised dealer code#DGFT code#export compliance India#export shipping bill#ICEGATE registration#Indian customs AD code#port registration India#taxcrux AD registration

0 notes

Text

Documents Required for Import-Export Registration

An Importer-Exporter Code (IEC) is a 10-digit alphanumeric code that is required for importing or exporting goods and services in and out of India. IEC may be applied on behalf of a firm which may be a Proprietorship, Partnership, LLP, Limited Company, Trust, HUF, or Society. The firm must have a PAN, a bank account in the name of the firm, and a valid address before applying. The address may be physically verified by the DGFT on issuance of the IEC. Please keep your PAN, bank details, and firm details ready before applying.

Different documents are required by different entities to get the IEC code and these are given below.

Proprietorship:

Digital Photograph (3x3cms) of the Proprietor.

Copy of PAN card of the Proprietor.

Copy of Passport (first & last page)/Voter’s I-Card/ Driving Licence/UID (Aadhar card) (any one of these)

Sale deed in case business premise is self-owned; or Rental/Lease Agreement, in case of office is rented/ leased; or latest electricity /telephone bill.

Bank Certificate as per ANF 2A(I)/ Cancelled Cheque bearing pre-printed name of the applicant and A/C No.

Partnership firm:

Digital Photograph (3x3cms) of the Managing Partner.

Copy of PAN card of the applicant entity.

Copy of Passport (first & last page)/Voter’s I-Card /UID (Aadhar Card) /Driving Licence/PAN (any one of these) of the Managing Partner signing the application.

Copy of Partnership Deed.

Sale deed in case business premise is self-owned; or Rental/Lease Agreement, in case of office is rented/ leased; or latest electricity /telephone bill.

Bank Certificate as per ANF 2A (I)/Cancelled Cheque bearing pre-printed name of the applicant entity and A/C No.

LLP or Private Limited Company or Section 8 Company:

Digital Photograph (3x3cms) of the Designated Partner/Director of the Company signing the application.

Copy of PAN card of the applicant entity.

Copy of Passport (first & last page)/Voter’s I-Card /UID (Aadhar Card) /Driving Licence/ PAN (any one of these) of the Managing Partner/Director signing the application.

Certificate of incorporation as issued by the RoC

Sale deed in case business premise is self-owned; or Rental/Lease Agreement, in case of office is rented/ leased; or latest electricity or telephone bill.

Bank Certificate as per ANF 2 A(I)/Cancelled Cheque bearing pre-printed name of the company and A/C No.

Society or Trust:

Digital Photograph (3x3cms) of the signatory applicant/Secretary or Chief Executive.

Copy of PAN card of the applicant entity.

Copy of Passport (first & last page)/Voter’s I-Card /UID (Aadhar Card) /Driving Licence/ PAN (any one of these) of the Secretary or Chief Executive/ Managing Trustee signing the application.

Sale deed in case business premise is self-owned; or Rental/Lease Agreement, in case of office is rented/ leased; or latest electricity /telephone bill.

Registration Certificate of the Society / Copy of the Trust Deed

Bank Certificate as per ANF 2A(I)/Cancelled Cheque bearing pre-printed name of the Registered Society or Trust and A/C No.

HUF:

Digital Photograph (3x3cms) of the Karta.

Copy of PAN card of the Karta.

Copy of Passport (first & last page)/Voter’s I-Card/ UID (Aadhar card)/ Driving Licence (any one of these) of the Karta.

Sale deed in case business premise is self-owned or Rental/Lease Agreement, in case office is rented/ leased or latest electricity /telephone bill.

Bank Certificate as per ANF 2A(I)/ Cancelled Cheque bearing pre-printed name of the applicant and A/C No.

#ImportExportRegistration#DGFTLicence#import export license#import export registration#import export code#iec code#dgft license#dgft code

0 notes

Text

Import Export IEC Code Registration Consultants in India | DGFT Services

Import Export Code (IEC) registration is a must for businesses engaged in international trade in India. Issued by the Directorate General of Foreign Trade (DGFT), the unique 10-digit code ensures smooth import and export operations. At YKG Global, we provide expert IEC registration consultancy, guiding you through the entire process with ease. Our team handles documentation, ensures timely submissions, and minimizes compliance risks, making the process hassle-free. Whether you're starting or expanding your global trade, our tailored solutions cater to your needs. Trust YKG Global for reliable, cost-effective DGFT services and focus on growing your business. Start your global trade journey today!

#business#company registration#consulting#taxation#business registration#investing#success#Import Export Code#IEC#IEC registration#DGFT#Directorate General of Foreign Trade

0 notes

Text

Unlocking Global Trade Insights: The Power of Import and Export Data

Businesses, analysts, and policymakers must comprehend import and export data in the connected global economy of today. Trade data provides vital information about global supply chains, competitive environments, and market trends. Access to precise and timely import-export trade data can be crucial for small exporters searching for new markets or multinational corporations honing their sourcing strategy.

What is Import and Export Data?

Import and export data refers to detailed records of goods traded between countries. These records usually include information such as:

Product descriptions and codes (usually using HS Code or Harmonized System)

Quantity and value of goods traded

Countries of origin and destination

Ports used in shipping

Names of importers and exporters (in some datasets)

Date and mode of shipment

Governments collect this data through customs declarations and publish it either publicly or through commercial channels.

Why Is Import Export Data Important?

Market Research & Opportunity Identification Businesses can identify which products are in high demand in specific countries. For example, if India is importing a high volume of electronics from China, it indicates a steady market demand that other suppliers may tap into.

Competitor Analysis With the help of import export data providers, companies can analyze their competitors’ trade volumes, sourcing strategies, and market reach. This transparency can fuel more strategic planning.

Supply Chain Optimization Importers can identify alternative suppliers, especially during disruptions. Exporters, on the other hand, can find new buyers globally, improving resilience and profitability.

Regulatory Compliance Knowing the proper HS code and documentation needed can ensure smooth customs clearance. Import export trade data also helps businesses stay compliant with regulations like anti-dumping laws or sanctions.

How to Access Import and Export Data

There are two main sources for accessing trade data:

Government Databases Many governments publish import/export statistics through trade ministries or customs departments. For instance, the U.S. International Trade Commission (USITC) or India’s Directorate General of Foreign Trade (DGFT) provide some free tools.

Import Export Data Providers Professional data providers offer more granular and actionable data, often including shipment-level details, company names, and advanced analytics tools. These services may come with a subscription fee but provide great value for in-depth market intelligence.

Some popular import export data providers include:

ImportGenius

Panjiva

Export Genius

TradeMap

Datamyne

These platforms often allow you to filter data by HS code, time period, country, product category, or company name, offering deep insights.

Applications of Import Export Trade Data

Business Expansion: A company producing solar panels can study which countries are importing such products and approach potential buyers.

Price Benchmarking: Traders can compare average prices per unit in different markets and negotiate better deals.

Trend Analysis: Historical data can highlight seasonal trends or emerging markets for certain products.

Customs Brokerage: Brokers can use the data to guide clients through documentation, tariffs, and regulations in different regions.

Challenges in Using Import Export Data

While powerful, this data isn’t always straightforward. Challenges may include:

Data Inconsistency: Not all countries report data in the same format or frequency.

Data Accessibility: Some detailed data sets are behind paywalls.

Privacy: In certain jurisdictions, business names in shipment-level data are restricted for privacy reasons.

Final Thoughts

Data that is imported and exported is a strategic asset that is more than just numbers. Businesses can confidently and clearly navigate global markets with the assistance of a trustworthy import export data provider. Import export trade data is your key to making well-informed, data-driven decisions, whether you're sourcing products, researching new markets, or evaluating the competition.

To stay ahead in the constantly changing world of commerce, embrace the power of global trade intelligence.

#Import And Export Data#Import Export Data Provider#import export data#Import Export Trade Data#Data Vault Insight

3 notes

·

View notes

Text

Digital Signature Certificate for Import-Export Code (IEC) Registration

The Import-Export Code (IEC) is a unique identification number required by businesses involved in the import or export of goods and services in India. One of the mandatory requirements for IEC registration is the submission of documents using a Digital Signature Certificate (DSC). This blog explains the importance of DSCs in the IEC registration process, how they are used, and why securing your DSC is crucial for your business’s growth in international trade.

What is the Import-Export Code (IEC)?

The Import-Export Code (IEC) is a key business identification number provided by the Directorate General of Foreign Trade (DGFT). It is mandatory for businesses wishing to engage in international trade activities. Whether you’re a manufacturer, wholesaler, or trader, an IEC is essential for clearing goods through customs, making payments for exports/imports, and availing other export benefits.

Why is a Digital Signature Certificate (DSC) Needed for IEC Registration?

E-Filing Requirement: The DGFT requires businesses to submit their IEC registration forms electronically via the DGFT portal. To sign and submit these online forms, you need a Digital Signature Certificate (DSC). This DSC ensures that the forms are validated and processed by the authorities without the risk of fraud.

Ensures Legal Validity: A DSC is recognized under the Information Technology Act, 2000, and serves as a legally valid electronic signature. This makes it possible for the IEC application to be processed legally, just like a traditional paper submission.

Prevents Tampering: The use of encryption technology in DSCs ensures that the information submitted for IEC registration cannot be altered once it’s been signed, thus preventing tampering or fraudulent modifications to the documents.

Faster Processing: Using a DSC speeds up the entire IEC registration process. Since the registration is done electronically, you can avoid delays associated with manual document submission and processing.

How to Apply for IEC Registration with a DSC

Obtain a Digital Signature Certificate (DSC): To apply for an IEC, you first need to obtain a DSC from a Certifying Authority (CA). You can choose between Class 2 and Class 3 DSCs, with Class 3 being the more secure option for business-related applications like IEC registration.

Prepare the Required Documents: The DGFT requires various documents for IEC registration, such as the PAN card, proof of address, bank certificate, and the identity of the applicant. Along with these documents, you will need your DSC to authenticate and sign the application.

Register on the DGFT Portal: Visit the DGFT’s official website and create an account. After registering, log in to complete the IEC application form online. During this process, you’ll be asked to upload your documents.

Attach the DSC: Once you’ve completed the form and uploaded all the necessary documents, you’ll need to sign the form using your DSC. This step ensures the authenticity of the registration application and validates your submission.

Submit the Application: After attaching your DSC, submit the application. The DGFT will process your application, and once it is approved, your IEC will be issued electronically.

Benefits of Using DSC for IEC Registration

Security: The encryption technology in DSCs secures your business’s data and ensures that sensitive information remains protected during the registration process.

Legitimacy: With a DSC, you can ensure that your IEC registration is legally valid, reducing the chances of rejection or delays due to discrepancies.

Efficiency: The use of DSC reduces the manual effort involved in IEC registration and ensures that your application is processed more quickly.

Reduced Fraud Risks: Since the DSC links your identity to the submitted documents, it prevents any fraudulent or unauthorized transactions, protecting your business from potential legal and financial issues.

Conclusion

A Digital Signature Certificate (DSC) plays an integral role in securing and facilitating the Import-Export Code (IEC) registration process. By ensuring the authenticity of your online submission and protecting your business’s sensitive data, a DSC is essential for those seeking to engage in international trade. For a smooth IEC registration experience, consult with the Best CA Firm in Delhi, which can help you obtain a DSC and guide you through the entire registration process, ensuring your business is ready for global expansion.

2 notes

·

View notes

Text

Online Registration Process for ICPTA Certificate, Fees & Documents

ICPTA Certificate is a Certificate of Origin issued by the Directorate General of Foreign Trade in India. ICPTA Certificate ensures that the commodity meant to be exported is completely manufactured or produced in the originating country or the exporting country. In order to verify the goods, the exporter has to produce multiple documents before the DGFT to prove that the goods have been manufactured in India.

The necessity for a Certificate of Origin is for custom clearance in the importing country.

Documents required for ICPTA Registration:

Organization based Digital Signature Certificate

DGFT Login IDUpdated Import Export Code

Digital Signature Certificate software

Mobile No. & Email address

Commercial Invoice

Purchase Bill that has details of quantity, origin of raw materials, consumables used in product meant for export

Manufacturer Exporter Declaration on the company’s Letterhead

Product Description

Purchase order from importer company

*If you want to know about EPR Registration_ click here

#ICPTACertificate#CertifiedICPTA#ProfessionalTraining#FinanceCredentials#ICPTAQualified#FinanceProfessional#AccountingCertification#InvestmentAnalysis#FinancialAdvisor#InvestmentManagement#CareerDevelopment#FinancialEducation

2 notes

·

View notes

Text

Get Your IEC Certificate Quickly with Corpseed

Want to start importing or exporting goods from India? An IEC Certificate (Import Export Code) is mandatory for any business involved in international trade. Corpseed offers expert assistance to help you obtain your IEC Certificate from DGFT through a simple, online process.

0 notes

Text

Eligibility Criteria for Export Finance for Exporters

In today’s global economy, Indian exporters are playing a crucial role in driving growth and expanding international trade. However, navigating the complexities of international markets often requires more than just a competitive product or service — it demands strong financial support. This is where export finance comes into play. It offers vital liquidity to exporters, enabling them to fulfill overseas orders efficiently.

Before diving into the process of availing such financial support, it's important to understand the eligibility criteria for export finance for exporters. Whether you are a startup venturing into exports or a seasoned player aiming to scale, knowing the prerequisites can streamline your journey.

What is Export Finance?

Export finance refers to financial assistance provided to exporters before or after shipment to manage the working capital gap. It includes various forms such as pre-shipment finance, post-shipment finance, packing credit, and bills discounting.

To learn more about our Export Finance Service tailored to Indian exporters, you can explore our solutions that ensure seamless funding and documentation support.

Key Eligibility Criteria for Export Finance

Banks and financial institutions have set several benchmarks to determine an exporter’s eligibility. Here are the major criteria:

1. Exporter Registration

The applicant must be a registered exporter with a valid Importer Exporter Code (IEC) issued by the Director General of Foreign Trade (DGFT). This is the primary identification for any Indian entity engaging in cross-border trade.

2. Proof of Export Orders

Exporters must furnish confirmed export orders or letters of credit (LCs) from international buyers. These documents serve as proof of pending payments and validate the requirement for financial assistance.

3. Business Vintage and Financial Stability

Although startups are not excluded, having at least 1–2 years of business operations and a healthy financial track record increases your chances of approval. Institutions assess balance sheets, turnover, and profit margins as part of risk evaluation.

4. KYC and Compliance Documents

Exporters must submit complete Know Your Customer (KYC) documents, including:

Company PAN and GSTIN

Address proof

Bank statements

Ownership details

Compliance with anti-money laundering laws and FEMA regulations is essential.

5. Satisfactory Credit Rating

Banks and NBFCs consider the creditworthiness of an exporter. A good credit rating and repayment history with other lenders enhance your eligibility. Some institutions might also consider CIBIL scores for individual proprietors or directors.

6. Nature of Goods Exported

Certain goods such as arms, wildlife, and restricted chemicals are subject to additional scrutiny. Exporters dealing in sensitive or banned items are typically excluded from financing schemes.

7. Collateral and Guarantees

Depending on the financial institution and type of finance (secured vs. unsecured), exporters might be asked to provide collateral or personal guarantees. Government schemes such as ECGC (Export Credit Guarantee Corporation) help mitigate risk for lenders.

Why Export Finance is Critical

Export finance helps bridge the gap between shipment and payment receipt, ensuring that exporters don’t face liquidity issues. It also allows you to accept larger orders without disrupting working capital for domestic operations.

Our Export Finance Service is designed to offer fast approvals, competitive rates, and full compliance support to MSMEs and large exporters alike.

Don’t Miss Out on GST Refunds

In addition to funding, exporters are eligible for GST Refund on the goods and services exported. Timely refunds improve your cash flow and reduce the burden of indirect taxes. If you’re looking to streamline this process, explore our specialized Export GST Refund Service, which ensures accurate filings, timely submissions, and end-to-end compliance with minimal manual intervention.

Conclusion

Securing export finance can be a game-changer for Indian exporters aiming to thrive in international markets. By meeting the eligibility criteria and staying compliant, exporters can unlock growth opportunities and meet global demand without financial stress. Whether you need capital to fulfill a large order or want to claim your export GST refund efficiently, professional support can make all the difference. Looking to get started? Check out our Export Finance Service and Export GST Refund Service to boost your export journey today.

0 notes

Text

How to Export Rice from India?

India is the largest exporter of rice, meeting the needs of both domestic and international markets. As per the sources, the annual approximate figure of rice export from India is 18 million tonnes. The increasing global demand for premium Indian basmati and non-basmati rice has positioned the country as a key player in the international market.

India’s rice export business is not limited to a single variety of rice but is spread across several varieties of rice such as parboiled rice exports, 1121 steam basmati rice, Sona Masoori rice, and PR11 non-Basmati rice to name a few. This blog will help you explore the factors behind export trends and reason behind increasing demand of rice export from India.

Process of Rice Export from India

Trust Only reliable suppliers: Export of rice demands reliability and trusted sources. Trust only reliable basmati rice exporters in India.

Premium- Quality: Ensure only the high-quality of basmati and non-basmati rice is exported as the export sector not only carries Indian rice but also the Indian standards and rich heritage.

Proper Storing of Rice: Packaging is one of the most important parts of the business, packaging of rice should meet the international guidelines with proper labelling.

Documentation: All requisite export documents must be collected to comply with the guidelines.

Shipping: Select the best shipping method and ensure collaboration with a reliable logistics company

Factors Driving large Scale Rice Export from India

Diverse range of rice varieties

India’s rice export portfolio is incredibly diverse catering to a wide range of global demand and consumer preferences. While India is kingpin of Basmati rice, it also has no dearth of varieties in non-basmati rice which was also visible during the duration of India rice exports ban as the ban of non-basmati rice exports from India highly impacted the world. India is a leading exporter of parboiled rice as well.

Competitive Pricing and High Volume of Production

Indian rice is competitively priced in comparison to other major rice exporting countries like Thailand and Vietnam. Premium quality with affordability makes Indian rice one of the most sought-after choices in international markets. Besides competitive pricing high volume of production ensures a steady surplus of export to meet global demand. Use of advanced farming techniques and govt. support boost Indian agricultural support which produces 120–130 million tonnes of rice annually.

Sustainable Farming Practices

India adopts sustainable practices of farming, such as the System of Rice Intensification(SRI) and Alternate Wetting and Drying (AWD) cultivation methods. Adoption of such practices creates an appealing sense for Indian rice.

Legal Requirements for Rice Export in India

Importer Exporter Code (IEC): This is mandatory for any commercial enterprise engaged in international exchange. Moreover, you can observe for IEC via the Directorate General of Foreign Trade (DGFT) internet site.

Register with APEDA: The Agricultural and Processed Food Products Export Development Authority (APEDA) regulates and promotes rice exports from India.

GST Registration: As an exporter, you need a GST Identification Number (GSTIN) for tax compliance.

FSSAI Certification: The Food Safety and Standards Authority of India (FSSAI) ensures that excellent food requirements are met earlier than export.

Top basmati rice exporting countries

Top basmati rice exporters in India

Shri Lal Mahal

Mahavir Rice & Gen. Mills

P.K. Overseas P. Ltd.

Galore Impex

Asm Global Inc

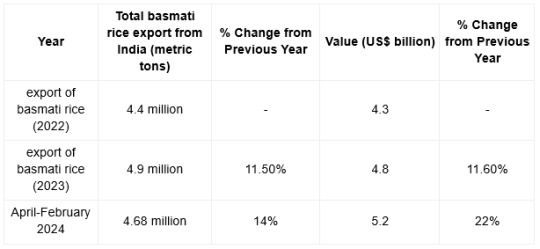

Key Insights of Export of Basmati Rice from India – 2024

Conclusion

The increasing global demand for Indian basmati and non-basmati rice is a testament to the country’s ability to cater to diverse market with varied consumer preferences. India is a leading exporter of rice with basmati rice leading the rice export sector. Exporters whether a new-comer in the market or the experienced one need to ensure that only the finest quality of rice reaches the global market that meets and satisfy all the legal requirements as well.

While exporting rice India does not only export food product but also exports the premium standards of Indian culture.

#iref#dr prem garg#indian rice exporters federation#prem garg#iref india#president of iref#basmati rice#basmati rice exporters#iref rice exporters#rice#rice export from india#non basmati rice exporters#non basmati rice exports#rice export#parboiled rice exports#basmati rice exporters in india

0 notes

Text

IEC Registration: A Complete Guide to Import Export Code in India

Introduction

If you're planning to start an import or export business in India, the first and foremost requirement is obtaining the IEC – Import Export Code. Issued by the Director General of Foreign Trade (DGFT), the IEC is a 10-digit unique code that is mandatory for anyone involved in the international trade of goods or services from India.

This article will guide you through the meaning, importance, eligibility, required documents, and step-by-step process of getting your IEC registration done online.

What is IEC (Import Export Code)?

The Import Export Code (IEC) is a unique 10-digit number issued by the Directorate General of Foreign Trade (DGFT) under the Ministry of Commerce and Industry, Government of India. It is required by businesses or individuals who wish to import or export goods and services from India.

Without an IEC, businesses cannot legally engage in international trade.

Who Needs IEC Registration?

IEC is mandatory for:

Importers – to clear shipments through customs

Exporters – to send shipments abroad

Freelancers and service exporters – if foreign remittances are involved

E-commerce sellers, who export products or services outside India

Note: IEC is not required for personal use imports/exports, and is not mandatory for service exports unless benefits are claimed under the Foreign Trade Policy.

Benefits of IEC Registration

International Market Access – Opens doors to global business expansion.

Government Benefits – Avail export promotion schemes like MEIS, SEIS, etc.

Easy Compliance – Once obtained, the IEC has lifetime validity, with minimal compliance.

No Return Filing – No need to file monthly or annual returns for IEC.

Quick Processing – The Entire application can be completed online within 1-2 days.

Documents Required for IEC Registration

You’ll need the following documents:

PAN Card – of the business or individual

Identity Proof – Aadhaar card / Passport / Voter ID

Address Proof – Electricity bill / Rent agreement / Sale deed

Bank Certificate or Cancelled Cheque

Digital Photograph – Passport-size

Business Registration Certificate – (For companies, LLPs, etc.)

How to Apply for IEC Registration (Online Process)

Follow these simple steps:

Step 1: Visit the DGFT Website

Go to the official DGFT portal – https://dgft.gov.in

Step 2: Register on the DGFT Portal

Create your user profile with a valid email and mobile number.

Step 3: Fill IEC Application Form (ANF 2A)

Provide business details, PAN, bank info, and upload required documents.

Step 4: Pay Application Fee

Pay the government fee of Rs. 500 via net banking or card.

Step 5: Submit and Track

Submit the form. You will receive the IEC certificate on your registered email, usually within 1-2 working days.

Validity & Renewal

The IEC code remains valid for the lifetime of the product.

As per recent amendments, you need to confirm/update your IEC details annually on the DGFT portal (even if there are no changes), between April and June. Failure to do so may deactivate the IEC.

Common Mistakes to Avoid

Incorrect PAN or mismatch in business name

Wrong bank details

Uploading unclear or incorrect documents

Missing annual IEC updates

Conclusion

IEC Registration is your business passport to the global market. Whether you're an individual exporter, MSME, or a large business house, IEC is essential to carry out international trade from India. The process is quick, cost-effective, and can be completed online with ease.

0 notes

Text

Best Import Export Code Registration Services in Noida

Planning to start an import or export business from Noida? The first step toward going global is getting your Import Export Code (IEC). At Aarya Solutions, we make the process simple, fast, and stress-free with our Best Import Export Code Registration Services in Noida.

What is IEC and Why Do You Need It?

The Import Export Code is a 10-digit identification number issued by the DGFT (Directorate General of Foreign Trade). It is mandatory for any individual or business involved in international trade — whether importing goods into India or exporting products abroad.

Without an IEC, you simply can't engage in cross-border trade legally. It's your business’s official ticket to global markets and a crucial step in becoming a recognized exporter or importer.

Why Choose Aarya Solutions?

We understand that government processes can be confusing and time-consuming. That’s why our team takes care of everything for you — from guiding you through documentation to submitting your application and securing your IEC certificate.

With us, you get:

Expert assistance at every step

Timely processing and application filing

Affordable and transparent pricing

Post-registration support when needed

Whether you're a startup, MSME, or established business, we tailor our service to match your needs.

Documents Required for IEC Registration

Getting your IEC is easier than you might think. Here’s what you’ll need:

PAN card of the business or individual

Aadhaar card or passport of the applicant

Address proof of the business

Bank details and a cancelled cheque

Business registration certificate (if applicable)

Just send us the documents, and we’ll handle the rest.

Let’s Get Started

If you're serious about taking your business international, don’t delay your IEC registration. Aarya Solutions is here to ensure it’s done quickly and correctly, without any hassle.

📞 Contact Us Today Phone: +91- 9811958408 Email: [email protected] Website: https://aaryasolutions.in/best-import-export-code-registration-services-in-noida.html

#IECNoida#ImportExportHelp#CodeRegistration#IECRegistration#TradeLicenseIndia#NoidaExportCode#DGFTRegistration#ExportStartUp#IECOnlineApply#ImportPermit

0 notes

Text

🌍 IEC Registration in India : Step-by-Step Guide for Importers & Exporters

1. Introduction The Import–Export Code (IEC) is a mandatory 10-digit identifier issued by the Directorate General of Foreign Trade (DGFT) for individuals and businesses conducting any cross-border trade of goods or services. IEC is essential for customs clearance, availing export incentives, filing shipping bills, and opening EEFC/FEMA-compliant accounts. 2. Eligibility Criteria for IEC…

0 notes

Text

Benefits Of Import Export Registration

The Importer Exporter Code (IEC) is an indispensable tool for businesses aiming to engage in international trade.

Here’s an in-depth look at the benefits of having an IEC:

1. Expansion of Business

Global Market Access: With an IEC, businesses can expand their operations to international markets, significantly increasing their potential customer base and revenue opportunities.

New Opportunities: International markets offer various opportunities for business growth. Companies can explore new product lines, cater to diverse customer needs, and establish partnerships with global players.

2. No Return Filing

Simplified Compliance: IEC does not require the holder to file periodic returns. This makes compliance straightforward and less time-consuming, allowing businesses to focus on their core activities.

One-Time Registration: The IEC is issued for the lifetime of the entity, eliminating the need for renewal.

3. Government Benefits

Export Promotion Schemes: The Indian government offers various export promotion schemes such as MEIS (Merchandise Exports from India Scheme) and SEIS (Service Exports from India Scheme).

Customs Clearance: An IEC is mandatory for the customs clearance of goods. It ensures smooth and hassle-free processing of import and export consignments, reducing delays and operational costs.

4. Banking Facilitation

Foreign Transactions: Banks require an IEC to process foreign exchange transactions related to international trade. This includes payments for imports and receipts for exports.

5. Recognition and Credibility

Official Recognition: Possession of an IEC provides official recognition to your business as a legitimate importer/exporter. This recognition can enhance your reputation and build trust with international customers and suppliers.

Brand Image: An Import-Export registration can improve your business's brand image in the global marketplace.

6. Reduction in Illegal Activities

Regulatory Compliance: The IEC ensures that businesses adhere to international trade regulations, thereby reducing the risk of engaging in illegal or fraudulent trade activities.

Transparency: Having an IEC brings transparency to cross-border transactions, helping regulatory bodies track and regulate trade activities effectively. This transparency also builds trust with trade partners.

#import export registration#DGFT License#Import Export License#iec license#IEC Code#Import Export Code#DGFT Code

0 notes

Text

Why Industrial Exporters Must File EODC Online Without Delay

Earlier, there used to be a lot of delay in the EODC online procedure. Keeping this in mind, later the Directorate General of Foreign Trade (DGFT) created an online procedure so that there is no delay and all the post-export requirements can be fulfilled on time.

In this fast-paced international environment, following the regulatory procedures is not just a formality but also a necessity. It becomes very important for Indian industries working under the advanced authorisation scheme to comply with the post-export regulations or export obligations within a specific period. If one delays or skips this step, it can have huge and serious legal, financial, and operational consequences. So, from this article, we will know why industrial exporters should always fulfil the EODC online procedure within the period without any delays. But before that, let us know what EODC is.

What is EODC?

The Export Obligation Discharge Certificate (EODC) is a document issued by the DGFT once an exporter has fulfilled the conditions of an Advance Authorisation license. This license allows the import of inputs duty-free, provided the exporter meets specific export obligations.

Once the export obligation is fulfilled, the exporter must apply for an EODC to close the license and confirm compliance. This process must be done online through the DGFT portal, ensuring transparency and speed in documentation.

Why Filing EODC Online Without Delay is Crucial

To Avoid Legal Penalties and Interest

The first and the biggest reason is that if EODC is not completed on time, then a lot of penalties are imposed on it, because when the EODC online process is not completed on time, it is considered that the exporter has failed to fulfil their export obligation. Now, if penalties are imposed, then the exporter's expenses will increase unnecessarily, and their production will be affected. This can lead to: Recovery of duty exemption, imposition of interest, adjudication proceedings, and show cause notices.

To Retain Duty Exemptions

The advanced authorisation scheme provides several important benefits to the exporter by allowing the import of raw materials or inputs without payment of Basic Customs Duty (BCD), IGST, and other applicable taxes. Now, if the exporter fails to file the EODC in any way, then DGFT considers that the exporter has tried to commit fraud, and this can happen with the exporter:

Demand payment of duty along with interest.

Cancel the license or block further incentives.

Suspend the IEC (Importer Exporter Code) temporarily or permanently.

Exporters must not treat duty-free imports as unconditional. The benefits only become final after EODC is issued.

Avoid Delay in Future Licenses and Incentives

An advanced license doesn't need to be required only once; exporters need it. Now, if they do not file EODC on time, then all the incentives, benefits, duty imports of DGFT, everything will be taken back, not only that time but also future incentives, licenses, everything will be taken back. First of all, DGFT will automatically reject it, and then when you go back, DGFT will not hear it. That is why it is the responsibility of every exporter to fulfil all the obligations, and if there is any due, then fulfil that too, so that there is no problem in the future.

Conclusion

An advanced authorisation scheme is a very powerful option and beneficial for exporters, but they just have to fulfil their export obligations post-export, so that DGFT does not take any legal action; otherwise, all the benefits will be withdrawn from the exporter, both future and present. In such a situation, filing of EODC becomes very important for exporters without any delay.

DGFT has provided all the possible benefits and smooth functioning ways to the exporters, now it is up to the exporters to take the responsibility and fulfil it to file the EODC online so that there is no obstacle in the future.

0 notes

Text

CCS Customs Experts in India – Trusted Compliance & Clearance Professionals

Partner with CCS Customs Experts in India for reliable customs clearance, DGFT compliance, and end-to-end import-export support. Fast, accurate, and government-compliant logistics services.

CCS Customs Experts – Your Trusted Partner in Customs Compliance and Clearance

In today's fast-paced global trade environment, navigating international customs regulations can be complex and time-consuming. That's where CCS Customs Experts come in—offering specialized knowledge, timely execution, and reliable customs clearance solutions tailored to your business needs. As trade regulations evolve and cross-border compliance becomes more stringent, CCS Customs Experts help importers and exporters streamline operations, avoid delays, and stay fully compliant with all legal and procedural requirements.

What Does CCS Customs Experts Offer?

CCS (Customs Clearance Services) Customs Experts are professionals trained in handling all facets of customs brokerage and international trade documentation. They serve as an essential bridge between businesses and government customs authorities, ensuring smooth movement of goods through international borders.

Core services typically include:

Import and export customs clearance

HS code classification

Duty and tax calculation

Regulatory compliance consulting

Liaising with customs officials

Managing customs documentation (bill of entry, shipping bills, etc.)

DGFT (Directorate General of Foreign Trade) services

Handling bonded warehousing and re-export procedures

Why Choose CCS Customs Experts?

1. Expertise in Indian Customs Regulations Navigating India’s customs laws can be complicated due to multiple ministries and regulatory bodies involved. CCS Customs Experts are well-versed in the Indian Customs Act, 1962, and Foreign Trade Policy (FTP), ensuring every shipment complies with current norms and avoids penalties.

2. Speed and Accuracy Delays at customs can lead to demurrage charges, missed delivery deadlines, and disrupted supply chains. CCS professionals ensure faster processing by preparing complete, accurate documentation and proactively addressing potential red flags.

3. Industry-Specific Knowledge Whether you're in pharmaceuticals, electronics, automotive, FMCG, or textiles, CCS Customs Experts understand sector-specific import/export rules and can optimize duty benefits under schemes like MEIS, RoDTEP, SEZ, and EPCG.

4. End-to-End Support From the moment your shipment leaves the supplier to its final delivery destination, CCS experts manage customs documentation, compliance, logistics coordination, and real-time tracking, offering total peace of mind.

5. Digital & EDI Filing CCS Customs Experts leverage modern platforms like ICEGATE for Electronic Data Interchange (EDI) filing, ensuring error-free, timely submission of documents to Indian Customs.

Benefits of Working with CCS Customs Experts

Reduced Risk: Avoid misclassification, overpayment of duties, and compliance breaches.

Time Savings: Streamlined processes mean faster clearance and quicker delivery.

Cost Efficiency: Optimized duty structures and benefits from trade agreements lower logistics costs.

Reliable Consultation: Stay updated with the latest changes in trade policies and customs laws.

CCS Customs Experts in India

With the growing complexity of global trade and increased scrutiny at Indian ports, CCS Customs Experts in India play a vital role in the logistics ecosystem. They are especially crucial at major hubs like Nhava Sheva (JNPT), Mumbai Airport, Delhi ICD, Chennai Port, and Mundra—where high cargo volumes and strict regulations demand seasoned professionals.

#CCSCustomsExperts#CustomsClearanceIndia#CCSIndia#ImportExportCompliance#DGFTSupport#CustomsBrokerIndia#LogisticsExperts#TradeComplianceIndia#FreightForwardingIndia#CustomsSolutions#EXIMIndia#CCSCompliance#CustomsConsultants#IndianTradeSupport#CargoClearanceIndia#CHAExperts#InternationalTradeIndia#SupplyChainIndia#TradeFacilitationIndia#CustomsDocumentation

0 notes

Text

Your Gateway to International Business Opportunities

In today’s borderless economy, international trade presents unmatched opportunities for entrepreneurs looking to scale their businesses. But before diving into exports, understanding the legal framework is essential. One of the first steps is securing an import export license in India, a critical document that enables you to trade goods globally with full compliance.

This license is more than just paperwork—it’s your entry ticket to a network of global buyers, suppliers, and marketplaces.

Why Explore International Business?

Tapping into international markets allows you to:

Reach Larger Customer Bases Access demand beyond your local market and diversify your revenue streams.

Boost Business Growth Leverage foreign exchange benefits and increase your profit margins.

Expand Brand Recognition Establish your business presence across borders and build global credibility.

Adapt to Competitive Trends Stay relevant by participating in global innovation and trade trends.

What You Need to Begin

To unlock these global opportunities, it's crucial to understand the import export license process. Here's what you should prepare:

PAN and Aadhaar for identity verification

Business registration documents

Bank account details

IEC (Importer Exporter Code) application through DGFT

Additionally, knowing how to apply for import export license in India simplifies the entire setup, saving time and avoiding legal hurdles.

The World Is Open for Trade—Are You Ready?

International business isn't just for big corporations. With the right licensing and a clear plan, even small businesses can make a mark. Start by obtaining your export license, explore market demand, and position your brand in the global arena.

Your gateway to success is just one step away.

#import export license in india#import export license process#how to apply for import export license in india#import export business license india#import export license requirements

0 notes